KW-100 Kansas withholding Tax Guide

Withholding Tax Rates for wages paid on and after January 1, 2021

PDF printable copy is located here.

Table of Contents

- INTRODUCTION TO WITHHOLDING TAX

- PAYMENTS SUBJECT TO KANSAS WITHHOLDING

- WITHHOLDING REGISTRATION

- HOW TO WITHHOLD KANSAS TAX

- SPECIFIC WITHHOLDING SITUATIONS

- KANSAS CUSTOMER SERVICE CENTER

- ANNUAL RETURNS AND FORMS

- ADDITIONAL INFORMATION

- OTHER REQUIREMENTS AND RESOURCES

- FORM K-4

- FORM CR-108

- TABLES FOR PERCENTAGE METHOD

- WAGE BRACKET TABLES

- TAXPAYER ASSISTANCE

INTRODUCTION TO WITHHOLDING TAX

Kansas has a state income tax on personal income. Kansas withholding tax is the money that is required to be withheld from wages and other taxable payments to help prepay the Kansas income tax of the recipient.

An employer or payer pays no part of this tax,but is responsible for deducting it from wages or taxable payments made to an employee or payee. The employer or payer holds the tax in trust for the state, and then remits these funds to the Kansas Department of Revenue on a regular basis.

WHO MUST WITHHOLD KANSAS INCOME TAX

As a general rule, every Kansas employer or payer who is required to withhold federal income tax according to the Internal Revenue Code must also withhold Kansas income tax.

EMPLOYERS

Kansas law defines an employer as any person, firm, partnership, limited liability company, corporation, association, trust, fiduciary or any other organization:- who qualifies as an employer for federal income tax withholding purposes;

- who maintainsan office, transacts business, or derives any income from sources within the state of Kansas (whether or not the paying agency is in Kansas);

- for whom an individual performs or performed services of any nature as the employee of such employer; and,

- who has control of the payment of wages for such services or is the officer, agent or employee of the person having control of the payment of wages.

A professional employer organization (PEO) is considered to be an employer for the purpose of withholding Kansas income tax from its assigned workers. A PEO is anyone engaged in providing, or representing itself as providing, the services of employees in accordance with one or more professional employer arrangements.

PAYERS

A payer is any person or organization, other than an employer, who makes a payment other than wages, or a payment of a pension, annuity or deferred income that is taxable under the Kansas income tax act. Kansas income tax withholding is required on payments other than wages (defined on page 4) that are made by payers to payees. Payers include trustees of pension funds and gambling establishments.

IMPORTANT: Even though the employer or payer itself may not be subject to Kansas income tax (such as governmental agencies or nonprofit religious, educational, or charitable institutions), the employer or payer is still required to withhold income tax from payments made to its employees or payees.

WHO ARE EMPLOYEES/PAYEES

EMPLOYEES

For Kansas withholding tax purposes an employee is either:

- a resident of Kansas performing services either inside or outside of Kansas; or,

- a nonresident of Kansas performing services within the state of Kansas.

Employers in other states are required to withhold Kansas income tax when the employee is a Kansas resident or when wages paid are for services performed in Kansas. Although an individual may be allowed considerable discretion and freedom of action, that person is considered an employee as long as the employer has the legal right to control what will be done, how it will be done, and the result of the services performed. If you have questions about whether an individual performing services for you is your employee (you are responsible for the payroll taxes on the wages paid) or is an independent contractor (the individual is responsible for taxes on the income), contact the Internal Revenue Service (IRS) or the Kansas Department of Labor in determining how to classify a worker.

IMPORTANT: Penalties may be imposed on persons who knowingly and intentionally mis-classify an employee as an independent contractor and fail to report state income tax withholding or unemployment insurance contributions.

PAYEES

A payee is any person or organization who receives apayment other than wages, or payment of a pension, annuity or deferred income which is subject to Kansas withholding. Examples include:

- Kansas residents receiving a taxable non-wage payment, or a taxable pension, annuity orother deferred income; and,

- nonresident individuals ororganizations receiving a management/consulting fee.

See the Payments Subject to Kansas Withholding section that follows for the types of payments subject to withholding tax. For examples of how to calculate Kansas withholding on taxable payments, see pages 6 through 8.

SOLE PROPRIETORS AND PARTNERS

If you are a sole proprietor or a partner in a partnership, you are not considered to be an employee of your business, and therefore will not withhold income tax on your compensation. Instead you will make quarterly estimated income tax payments to prepay your state income tax liability on taxable income.

PAYMENTS SUBJECT TO KANSAS WITHHOLDING TAX

As a general rule, if federal income tax withholding is required on the payment, Kansas withholding is also required. If federal withholding is voluntary, Kansas withholding is generally voluntary as well.

WAGES

Wages are all payments, whether in cash or other form, paid by an employer to an employee for services performed. If the payment is a wage as defined by section 3401(a) of the federal internal revenue code, it is subject to Kansas income tax withholding when

- the recipient is a resident of Kansas OR the services were performed in Kansas; and,

- the payment issubject to federal income tax withholding.

Exception: Wages paid to an individual who performs services as an “extra” in connection with any phase of a motion picture or television production or commercial for less than 14 days during any calendar year are not subject to Kansas withholding tax. An “extra” is an individual who pantomimes in the background, adds atmosphere and performs such actions without speaking.

SUPPLEMENTAL WAGES

Supplemental wages are compensation paid to an employee in addition to the employee’s regular wage. They include, but are not limited to, bonuses, commissions, overtime pay, accumulated sick leave, severance pay, and back pay.

Kansas withholding is required on all supplemental wage payments. How you calculate the Kansas withholding depends on how the payment is made; see page 8, Supplemental Wages.

FRINGE BENEFITS

In general, any fringe benefit that is included in an employee’s gross income and subject to federal withholding tax is also subject to Kansas withholding tax. Fringe benefits include cars and flights on aircraft you provide, free or discounted commercial flights, vacations, discounts on goods or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

CAFETERIA, 401K, and PROFIT SHARING PLANS

Kansas law requires withholding on wages. If your cafeteria, 401K, profit sharing, or other employee plan is considered to be wages by the federal government and federal income tax withholding is required, Kansas withholding is also required.

PAYMENTS OTHER THAN WAGES

Kansas withholding is required on these taxable payments other than wages when federal withholding is required [K.S.A.79-3295]. Any determination by the IRS that relieves a payer from withholding on these payments also will apply for Kansas income tax withholding purposes.

- Any supplemental unemployment compensation, annuity or sick pay

- Payments made pursuant to a voluntary withholding agreement

- Gambling winnings

- Taxable payments of Indian casino profits

- Payments of any vehicle fringe benefit

MANAGEMENT AND CONSULTING FEES

Kansas requires withholding on management and consulting fees paid in the ordinary course of a trade, business or other for profit venture to a nonresident of Kansas performing these services in Kansas (i.e., earning taxable Kansas source income). The requirement to withhold Kansas tax on these fees does not apply to individuals, governmental or nonprofit entities, since they are not for-profit ventures. See the sample calculation on page 8.

PENSIONS, ANNUITIES AND OTHER DEFERRED INCOME

Kansas withholding may also apply to pensions, annuities or deferred income paid to a Kansas resident. To be subject to withholding, the payment must be taxable under the Kansas income tax act and be:

- periodic payments of pensions, annuities and other deferred income; or,

- nonperiodic distributions of pensions, annuities and other deferred income; or, eligible rollover distributions of pensions, annuities and other deferred income.

NOTE: Kansas withholding is required only when federal withholding is required. If federal withholding is voluntary on these payments, Kansas withholding is also voluntary.

EXAMPLE: You are a payer of a taxable pension on which federal withholding is not required; however, the Kansas resident payee elects to have federal withholding deducted from that pension. Since the federal withholding is voluntary, Kansas withholding is also voluntary.

Kansas withholding on deferred compensation plans follows federal withholding rules. Contributions to a deferred compensation plan are generally not subject to withholding. However, if federal withholding is required on a taxable distribution from a deferred compensation plan, Kansas withholding is also required.

INTEREST AND DIVIDENDS

Federal law requires back-up withholding on interest and dividend income in some situations. Kansas law does not contain a similar provision, therefore there is no Kansas withholding on interest and dividend income.

LOTTERY and GAMBLING WINNINGS

Kansas income tax must be withheld from prizes paid by a Kansas-based lottery, casino or pari-mutuel wagering establishment when federal withholding is required. How to withhold Kansas tax on gambling winnings is explained on page 8, Gambling Winnings.

WITHHOLDING REGISTRATION

WHO MUST REGISTER

If you are an employer or payer as defined on page 3, you must register with the Kansas Department of Revenue to withhold Kansas income tax from wages and other taxable payments subject to Kansas withholding tax. If you are an employer in another state, you must register and withhold Kansas income tax when you have employees working in Kansas for any period of time.

COMMON PAYMASTERS

If your corporation is acting as a common paymaster (as defined by the Internal Revenue Service) for employees who are working for and being paid by two corporations at the same time, you will register and report your Kansas income tax withholding as a common paymaster using the Kansas Tax Account Number with the same EIN as is used to report the federal withholding as a common paymaster.

REPORTING AGENTS

If you are a reporting agent for one or more employers, you must report Kansas income tax withholding for these employers under the Kansas Tax Account Number(s) of the individual employers, not under your Kansas Tax Account Number.

HOW AND WHEN TO REGISTER

You do not need to apply for a Kansas withholding tax account number until you have employees working in Kansas, or are required to withhold on payments that are subject to Kansas withholding tax.

To apply for a tax number, visit ksrevenue.org and sign in to the KDOR Customer Service Center. After you complete the application you will receive a confirmation number for your registration and account number(s). For complete instructions about the application process, obtain Pub. KS-1216, Business Tax Application and Instructions, from our website.

If you prefer, you may apply in person or by mail. An owner, partner, or a principal officer may bring the completed application to our assistance center. We will process your application, assign a registration number, and issue a Certificate of Registration if you have no outstanding taxliability. You may, instead, mail or fax your completed application to our office 3-4 weeks before you begin making withholding tax payments.

YOUR KANSAS TAX ACCOUNT NUMBER

Your Kansas account number for withholding tax is a 15-character number based on your federal Employer Identification Number (EIN) as illustrated here.

| 036 | 481234578 | F01 |

|---|---|---|

| (Tax Type) | (EIN) | (Tax Account) |

The tax type prefix for withholding tax on wages and taxable non-wage payments is 036; for nonresident owner withholding it is 037. If you are registered with the Department of Revenue for sales or use tax, the prefix will change to denote those tax types. Include your tax account number on any correspondence mailed to the department.

If there is a change in the ownership of the business, a new Kansas Tax Account Number may be required. See Reporting Business Changes on page 14.

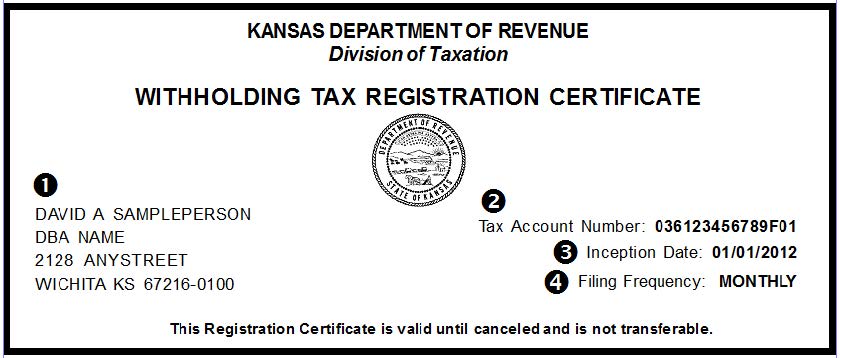

YOUR REGISTRATION CERTIFICATE

After your account number is assigned, a withholding tax registration certificate is issued to you (see following sample). Be sure to review it for accuracy and report any corrections to the Department of Revenue immediately.

ITEM 1: Employer/Payer Name and Address

The name/business name under which your account is registered.The address is the current physical location of your business. DBA means “Doing Business As.”

ITEM 2: Tax Account Number

A number assigned by theDepartment of Revenue to record your withholdingaccount information.

ITEM 3: Inception Date

The start date of your business, the datewages were first paid, or the date you began making payments subject to withholding as indicated on your Business Tax Application.

ITEM 4: Filing Frequency

How often you will report and pay Kansas withholding tax: quad-monthly; semi-monthly, monthly, quarterly, or annually. Your filing frequency is assigned based on the size of your payroll. See Filing Frequencies and Due Dates and the chart here.

HOW TO WITHHOLDKANSAS TAX

KANSAS WITHHOLDING ALLOWANCE CERTIFICATE

In order to have Kansas tax withheld, every employee must furnish to the employer a signed K-4 Kansas Withholding Allowance Certificate, for use in computing Kansas withholding. For federal withholding purposes, you will continue to use Form W-4.

The K-4 form should be completed as soon as an employee is hired or taxable payments begin. The amountof tax withheld should be reviewed each year and new forms should be filed whenever there is a change in either the marital status or number of exemptions of the individual. If an employee does not complete a Form K-4, the employer must withhold wages at the single rate with no allowances.

NOTE: Individuals who have a balance of more than $500 on their Kansas income tax return after all credits may be subject to an underpayment penalty. To avoid this, you can make estimated tax payments, reduce the number of withholding allowances claimed, or request an additional amount of Kansas withholding.

ADDITIONAL KANSAS WITHHOLDING

The amounts calculated using the tables in this booklet represent the minimum amount of Kansas withholding on each payment. Because of their particular tax situation, employees may request additional amounts above the regular Kansas withholding amount in order to have sufficient credits to avoid a balance due on their income tax return or a penalty for underpayment of estimated tax. Employees will use line 5 of Form K-4 to report additional amounts of Kansas tax to be withheld.

EXCLUSION FROM KANSAS WITHHOLDING

When an employee claims exemption from federal withholding, the employee is also exempt from Kansas withholding. However, if the IRS requires withholding for an individual who has previously claimed exemption from withholding, Kansas withholding tax is also required.

IMPORTANT: An exemption or exclusion from Kansas withholding does not mean an individual does not have to file a Kansas individual income tax return and pay the Kansas income tax due.

HOW TO COMPUTE KANSAS WITHHOLDING

There are two methods you may use to determine the amount of Kansas income tax to be withheld from a wage or other payment subject to Kansas income tax withholding — the percentage formula and the wage bracket tables. Both methods use a series of tables for single and married taxpayers for each type of payroll period frequency (weekly, monthly, etc.). Be sure to use the correct table for your payroll frequency and the martial status of the payee so that you arrive at an accurate withholding amount.

Using the wage bracket tables is considered to be the easier of the two methods. However, if you have highly paid employees/payees or are using a computerized payroll system, you (or your software) will use the percentage formula. Both methods are acceptable and produce almost identical results. Choose the method that best suits your payroll situation.

PERCENTAGE FORMULA

The percentage formula is a mathematical formula based on the Kansas personal income tax rates. This method uses the tables that are on pages 18 and 19. The percentage rate tables are based on the net wage or payment amount. To compute the net amount of the payment, you must first calculate the employee’s/payee’s withholding allowance amount and deduct it from the gross wage or payment for the period before using the percentage rate tables.

WITHHOLDING ALLOWANCE AMOUNT

An individual’s withholding allowance amount is the Kansas individual income tax personal exemption amount of $2,250 divided by the number of payroll periods in the calendar year. Thus, an employee paid monthly has a withholding allowance of $2,250 divided by 12, or $187.50, per pay period for each withholding allowance claimed. The Kansas withholding allowance amounts for each payroll frequency are shown in this table:

WITHHOLDING ALLOWANCE AMOUNTS TABLE

| Payroll Frequency | Number of pay periods per year | Amount of each withholding allowance |

|---|---|---|

| Daily or Miscellaneous (Each day of payroll period) | 260 | $8.65 |

| Weekly | 52 | $43.27 |

| Bi-weekly | 26 | $86.54 |

| Semi-monthly | 24 | $93.75 |

| Monthly | 12 | $187.50 |

| Quarterly | 4 | $562.50 |

| Semi-Annual | 2 | $1,125.00 |

| Annual | 1 | $2,250.00 |

ROUNDING

Kansas withholding computed using the percentage method may be rounded. Round to the nearest whole dollar by dropping amounts under 50 cents and increasing amounts from 50 to 99 cents to the next higher dollar. For example, $2.49 becomes $2 and $2.50 becomes $3.

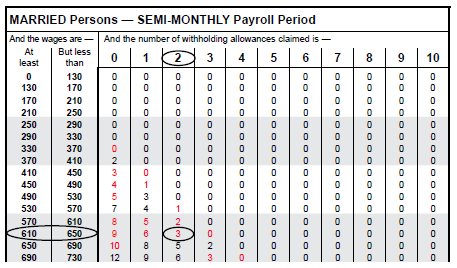

WAGE BRACKET TABLES

This method uses the series of tables that begin on page 21. The wage bracket tables are calculated using the percentage formula, with the results rounded and placed in convenient brackets for you. Withholding is computed by plotting the gross wage and the number of withholding allowances on the table that corresponds with your payroll frequency and the individual’s marital status.

IMPORTANT: When the payment for the period exceeds the last bracket of a wage bracket table, you must use the percentage formula to calculate the amount of tax to withhold on the entire payment.

SAMPLE WITHHOLDING COMPUTATIONS

The two methods of calculating Kansas withholding tax (Percentage Formula and Wage Bracket Table) are illustrated for you using the following example.

EXAMPLE: Sal Salansky is paid $625 semi-monthly, is married, and has filed with his employer the Federal W-4 form and the Kansas K-4 form, claiming two withholding allowances.

PERCENTAGE FORMULA

STEP 1: Multiply the withholding allowance amount for Sal’s payroll frequency of semi-monthly (see table to the left) by the total number of withholding allowances that he claimed on his Kansas K-4 form, which is 2: $93.75 X 2 = $187.50

STEP 2: Subtract the result in Step 1 from Sal’s gross payment for the period to arrive at the net payment amount:

$625 - $187.50 = $437.50

Use the appropriate rate table (Table 3 for Semi-Monthly payroll below) to figure the amount to be withheld for Sal. Since he is married, use Table 3(b). The withholding rate is 3.1% of the net amount of the wage or payment that is over $333.00.

$437.50 - $333.00 = $104.50

$104.50 X 3.1% = $3.24

STEP 3: The Kansas withholding on Sal’s payment is $3.24, which may be rounded to $3.00.

Table 3 - Semi-Monthly Payroll Period

Table A for a SINGLE person (including head of Household)

| Amount of wages (after withholding allowance) is over | Amount of wages (after withholding allowance) is not over | The amount of KANSAS income tax to be withheld is |

|---|---|---|

| $0 | $146 | $0 |

| $146 | $771 | 3.1% of excess over $146 |

| $771 | $1,396 | $19.38 plus 5.25% of excess over $771 |

| $1,396 | No limit | $52.19 plus 5.7% of excess over $1,396 |

Table B for a MARRIED person

| Amount of wages (after withholding allowance) is over | Amount of wages (after withholding allowance) is not over | The amount of KANSAS income tax to be withheld is |

|---|---|---|

| $0 | $333 | $0 |

| $333 | $1,583 | 3.1% of excess over $333 |

| $1,583 | $2,833 | $38.75 plus 5.25% of excess over $1,583 |

| $2,833 | No limit | $104.38 plus 5.7% of excess over $2,833 |

WAGE BRACKET TABLE

STEP 1: Select the withholding table that represents Sal’s payroll period frequency of “semi-monthly” and his marital status of “married” (see illustration below).

STEP 2: Locate the wage bracket on the left side of the table that encompasses the gross amount of Sal’s semi-monthly payment of $625. Then, across the top of the table, locate the number of withholding tax allowances claimed on Sal’s K-4 form.

STEP 3: Locate where the wage row and withholding allowance column meet within the table. For this example, the wage bracketof 610 - 650 and the column for 2 withholding allowances intersect at $3 – this is the amount of Kansas tax to withhold on Sal’s payment.

CAUTION: The column headings for the wage brackets are “At Least … But Less Than.” If the gross payment falls on a break, use the next wage bracket or line down. For example, if the payment is $570, you would use the $570 - $610 wage bracket, NOT the $530 - $570 wage bracket.

SPECIFIC WITHHOLDING SITUATION

This section is designed to help employers and payers accurately calculate Kansas withholding tax on the various residency situations and taxable payments subject to Kansas withholding.

KANSAS RESIDENTS

A Kansas resident is any individual who has established a permanent residence in Kansas for any period of time during the year, or spent a total of more than 6 months in Kansas during the year.

Resident Working Full Time In Kansas

If your employeeis a Kansas resident performing services entirely in Kansas, Kansas withholding tax is due on the total earnings.

Resident Working Outside Kansas

When you employ or pay a Kansas resident for services performed outside Kansas (either full time or part time), withhold from that employee’s total wages the amount of withholding tax due Kansas, less the amount of withholding tax required by the other state(s).

EXAMPLE: Jane lives in Kansas but she works in Missouri. The amount of Kansas withholding tax due on Jane’s total wage is $250 and the Missouri withholding is $130. The difference, $120, will be withheld from Jane’s paycheck and sent to Kansas.

NOTE: If the other state’s withholding is more than the Kansas amount, then no Kansas withholding tax is due.

NONRESIDENTS OF KANSAS

A nonresident individual is any individual other than aresident individual.

Nonresident Working Full Time in Kansas.

If a nonresident works full time in Kansas, the employer must withhold Kansas income tax from the employee’s total wages as if the employee were a Kansas resident.

Nonresident Working Inside and Outside of Kansas.

The computation of Kansas withholding tax for a nonresident employee who performs services for an employer both inside and outside of Kansas is a two-step process. First, the employer computes the Kansas withholding tax amount on the total wages paid during the period. Second, the resulting amount of Kansas withholding is then multiplied by a nonresident percentage factor.

The nonresident percentage is obtained by dividing the employee’s services performed in Kansas by the total services performed.

A Statement of Nonresident Allocation Percentage (K-4C), may also be used by nonresident recipients of taxable Kansas income to report the approximate percentage ofincome earned in Kansas and subject to Kansas withholding. The form is completed by the recipient and kept on file by the employer or payer.

Computing the nonresident percentage: The numerator (Kansas services) and denominator (total services) of the nonresident percentage are usually determined by how the employee is paid: hourly, salary, commission, etc. The following are examples of how to compute these types of wage payments. However, any logical method that accurately and fairly reflects the percentage of income earned in Kansas may be used.

Hourly Employee

Hours worked in Kansas divided by total hours worked equals % of income applicable to Kansas.

EXAMPLE: Rick lives in Missouri but works in Missouri and Kansas for the same employer. He is paid by the hour. He worked 33 of 80 hours in Kansas and the Kansas withholding on his total wage is $34. Determine his nonresident percentage by dividing the number of hours worked in Kansas (33) by the total hours worked in the pay period (80). 33 ÷ 80 = 41%.

Since Rick’s Kansas earnings are 41% of the total, hisnonresident Kansas withholding is .41 X $34 = $13.94, which is rounded to $14.

Salaried Employee

Days worked in Kansas divided by total days worked equals % of income applicable to Kansas.

EXAMPLE: Susan lives in Nebraska and paid a salary for her work in Nebraska and Kansas. During a two-week pay period, she worked 7 of 10 days in Kansas. The Kansas withholding on her total salary for the period is $50. To determine her nonresident percentage, divide the number of days she worked in Kansas (7) by the total number of days worked in the pay period (10). 7 ÷ 10 = 70%.

Therefore, Susan’s nonresident Kansas withholding tax is 70% of the Kansas withholding tax on her total salary: $50 X .70 = $35.

Commission Sales Associate

Commision earned in Kansas divided by total commision earned = %of income applicable to Kansas

EXAMPLE: Jonathan lives in Colorado and is a commission salesman in several states, including Kansas. His total commissions for the period were $2,612, of which $523 were from Kansas. Kansas withholding on his total commissions is $116. His nonresident percentage is determined by dividing his Kansas commissions by his total commission: $523 ÷ $2,612 = 20%.

Jonathan’s Kansas commissions are 20% of his total commissions, so his nonresident Kansas withholding is: .20 X $116 = $23.20, which is rounded to $23.

EMPLOYEES OF INTERSTATE CARRIERS

Employees in interstate commerce (railroads, motor carriers, air carriers, etc.) often perform their regularly assigned duties in more than one state. Kansas withholding rules for employees of interstate carriers are governed by federal law – Public Law 91-569. Wages paid to these employees are subject only to the income tax laws of their state of residence. Interstate carriers are required to file an information return (Form W-2 or 1099) with the state of the employee’s residence.

ENTERTAINERS AND ATHLETES

Individuals working in sports and entertainment often have income in more than one state. Like others working in Kansas, athletes and entertainers are subject to the Kansas personal income tax on earnings for services performed in Kansas. Therefore, Kansas withholding is required on their Kansas earnings if the Internal Revenue Service considers them your employees. If the individual employee is a nonresident of Kansas, the nonresident percentage may be calculated as the ratio of the number of hours, number of games or number of performances in Kansas to the total number of hours, games or performances for the pay period.

EXAMPLE: Jack is a resident of Iowa and plays semi-pro baseball. During a pay period he played in 7 games, 2 of which were in Kansas. The Kansas withholding on his total wage is $150. His nonresident percentage is the number of games played in Kansas (2) divided by the total games in the pay period (7): 2 ÷7 = 28%. Since his Kansas earnings are 28% of the total, his nonresident Kansas withholding is .28 X $150 = $42.

EXAMPLE: Jane is a Texas resident and an actor who is paid a weekly salary. Her touring company spent 36 days in Kansas. For pay periods when all performances were in Kansas, Kansas withholding is due on the total weekly wage. For pay periods when only part of the performances were in Kansas, her employer would apply a nonresident percentage (the ratio of Kansas performances to the total) to the Kansas withholding on her total earnings for the week. Kansas withholding is not required if the individual is considered to be an independent contractor. Independent contractors with Kansas taxable earnings would make estimated tax payments on their Kansas taxable income.

GAMBLING WINNINGS

Kansas withholding on gambling proceeds is not computed using the wage bracket or percentage formula tables, but is instead 5% of the proceeds paid. To figure the Kansas withholding on gambling winnings, multiply the proceeds paid (the amount won less the amount of the bet) by 5%. Enter the Kansas information in the applicable boxes of the W-2G.

MANAGEMENT AND CONSULTING FEES

Management and consulting fees paid to a nonresident are subject to Kansas withholding tax at the rate of 5% of the fee when payment is made by a Kansas entity in the normal course of its trade, business or other for-profit venture, and the nonresident physically performs these services in Kansas.

EXAMPLE: A Kansas real estate firm pays a Missouri company $1,000 per month to manage its Kansas rental property. Since the Missouri firm performs the management services in Kansas, the Kansas firm is required to withhold Kansas tax at the rate of 5% from each payment made to the Missouri company.

NONRESIDENTS ALIENS

Citizens of other countries working in Kansas may be subject to Kansas withholding and Kansas personal income tax on their earnings. If the wages paid to a nonresident alien for services performed in Kansas are subject to federal income tax withholding, Kansas income tax withholding is also required.

OTHER MISCELLANEOUS PAYMENTS

You will use the percentage formula or wage bracket tables to figure Kansas withholding on most payments. However, when you are making a payment subject to Kansas withholding not discussed here, and the federal withholding is a percentage (20%, 25%, etc.), the Kansas withholding rate is 5% of the payment.

SUPPLEMENTAL WAGES

Kansas withholding on a supplemental wage payment is computed using the same method that you use at the federal level. If you are adding regular and supplemental wages together and computing federal withholding on the total using the federal tables, compute the Kansas withholding using the same steps.

EXAMPLE: You pay Joan a $1,000 bonus in addition to her regular wage of $1,000. Since you are not separating the payment, you calculate federal and state withholding using a gross wage amount of $2,000 for the period.

In contrast: If you state the supplemental wage separately and compute federal withholding as a percentage of the payment (usually 25%), then compute Kansas withholding at 5% of the gross payment. For example, Kansas withholding on a $1,000 bonus paid would be $50 ($1,000 X 5%).

KANSAS CUSTOMER SERVICE CENTER

FILE, PAY and MAKE UPDATES ELECTRONICALLY

Most businesses have chosen the KDOR Customer Service Center (KCSC) for their online filing and payment solution. To use this solution, you simply create a user login ID and select a password, then you can attach your business tax accounts. Each tax account has a unique access code that only needs to be entered once. This access code binds your account to your login ID. For future filings, you simply log into your account using your self-selected user login and password. A history of all filed returns and/or payments made is retained in the KCSC.

WHAT CAN I DO ELECTRONICALLY?

- Register to collect, file and pay taxes and fees

- Add new locations

- Complete and submit a Power of Attorney form

- Update contact information

- Update mailing address

- Upload W-2’s and 1099’s

- Upload and retain Sales and Compensating Use Tax jurisdictions

- File the following tax returns:

- Retailers’ Sales Tax•Retailers’ Compensating Use Tax

- Consumers’ Compensating Use Tax

- Liquor Drink and Liquor Enforcement Tax

- Make payments for the following taxes:

- Individual Income

- Individual Estimated Income

- Homestead

- Fiduciary

- Withholding

- Corporate Income

- Corporate Estimated Income

- Privilege

- Privilege Estimated Income

- Sales and Use

- Liquor Drink and Liquor Enforcement

- ABC Taxes and Fees

- Petition for Abatement Service Fee

- Motor Fuel

- Environmental and Solvent Fee

- Dry Cleaning Payment Plan Fee

- Tire Excise

- Charitable Gaming

- Vehicle Rental

- IFTA

- Cigarette Tax, Fees, Fines and Bonds

- Tobacco Tax, Fees, Fines and Bonds

- Transient Guest

- Mineral

REQUIREMENTS TO FILE and PAY

You must have the following in order to file and pay your taxes online:

- Internet Access

- Access Code(s) by calling 785-368-8222 or send an email to kdor_businesstaxeservice@ks.gov

- EIN

- ACH Debit: Kansas Department of Revenue debits the tax payment from your bank account

- ACH Credit: Complete an EF-101 online to initiate a tax payment through your bank

Electronic tax payments must settle on or before the due date. Using the KCSC, you may have your tax payment electronically debited from your bank account (ACH Debit) or you may initiate your tax payment through your bank (ACH Credit). This payment method requires a completed authorization EF-101, available on our Kansas Customer Service Center.

Our FREE electronic systems are simple, safe, and conveniently available 24 hours a day, 7 days a week. You will receive immediate confirmation that your return is filed and/or payment is received. If you need assistance with your access code, you may call 785-368-8222 or email (kdor_businesstaxeservice@ks.gov)

PAY BY CREDIT CARD

Taxpayers can make their Individual Income tax and Business tax payments by credit card. This service is available on the Internet through third-party vendors; ACI, Inc (ACI) or Value Payment Systems (VPS). These vendors charge a convenience fee based on the amount of tax being paid. This fee may vary by vendor. Credit card transactions are strictly between the vendor and the taxpayer. Likewise, any disputes specific to the card payment will be between those two parties. Rules regarding the credit card transactions are available at each vendor’s website.

Credit cards that are available for each vendor are as follows:

ACI, Inc. (ACI)

- American Express

- Discover

- MasterCard

- Visa

Payments can be made by accessing their website at www.acipayonline.com or by calling 1-800-2PAYTAX (1-800-272-9829). The Kansas jurisdiction code is 2600. For payment verification inquiries, call 1-866-621-4109. Allow 48 hours for processing. Tax types that can be paid through ACI, Inc. are as follows:

- Individual Income Tax Return

- Individual Estimated Income Tax

- Corporate Income

- Privilege Tax

- Liquor Tax

- Mineral Tax

- Motor Carrier Property Tax

- Motor Fuels Tax

- Sales and Use Tax

- Withholding Tax

Value Payment Systems (VPS)

- Bill Me Later ®

- Discover

- MasterCard

- Visa

- Debit Card

VPS processes payments for Kansas Individual Income Tax only. For payment verification inquiries, call 1-888-877-0450. Allow 48 hours for processing.

Tax types that can be paid through Value Payment Systems are as follows:

- Individual Income Tax

- Individual Estimated Income Tax

WIRE TRANSFERS

Wire transfers are accepted from both domestic and foreign banking institutions as long as it is received as American currency. For more information call 785-368-8222.

RECORD KEEPING

Like all other aspects of your business operation, you must keep current, complete and accurate withholding records. Keep records for at least 3 years after the date the withholding tax was due, or paid, whichever is later.

- Name, current address, and Social Security number of each employee or payee

- Period(s) of employment

- All compensation amounts paid by pay period

- Date(s) and amount(s) of all tax withheld

- Copies of documents filed with the Department of Revenue (KW-5, KW-3, W-2, 1096 and 1099)

- Federal form W-4 (W-4P, W-4S, W-4V, etc.) and Kansasform K-4 for each employee/payee

FILING FREQUENCIES AND DUE DATES

How often you will file and pay Kansas withholding tax depends on the size of your payroll. The larger your payroll, the larger the Kansas withholding, and therefore the more frequently you will report and pay the tax. Kansas has five filing frequencies — annual, quarterly, monthly, semi-monthly,and quad-monthly. Your initial filing frequency is based on the estimated tax amount you enter in Part 6 of the business tax application. Your filing frequency is shown on your Withholding Registration Certificate as illustrated on page 5.

Each filing frequency has a different set of due dates (see chart below). Do not file your Kansas withholding tax eithermore or less frequently than your established filing frequency. If a change in filing frequency is needed (monthly to quarterly, etc.), follow the instructions on page 15. If the due date falls on a Saturday, Sunday or legal holiday, use the next regular business day.

CAUTION: Annual withholding amounts and filing frequencies are prescribed by Kansas law [K.S.A. 79-3298(a)]. If the taxation director has cause to believe money withheld by an employer or payer may be converted, diverted, lost, or otherwise not timely paid, the director may at any time require returns/payments more frequent than prescribed in the following chart. [K.S.A. 79-3298(f)]

DUE DATES FOR WITHHOLDING TAX DEPOSIT REPORTS

If a due date falls on a Saturday, Sunday or legal holiday, use the next regular workday.

QUAD-MONTHLY - ANNUAL WITHHOLDING $100,000.01 and ABOVE: Reports are due within three banking days of the 7th, 15th, 21st and the last day of the month.

SEMI-MONTHLY - ANNUAL WITHHOLDING $8,000.01 to $100,000.00:

| REPORTING PERIOD | DUE DATE |

|---|---|

| January 1-15 | January 25 |

| January 16-31 | February 10 |

| February 1-15 | February 25 |

| February 16-28 | March 10 |

| March 1-15 | March 25 |

| March 16-31 | April 10 |

| April 1-15 | April 25 |

| April 16-30 | May 10 |

| May 1-15 | May 25 |

| May 16-31 | June 10 |

| June 1-15 | June 25 |

| June 16-30 | July 10 |

| July 1-15 | July 25 |

| July 16-31 | August 10 |

| August 1-15 | August 25 |

| August 16-31 | September 10 |

| September 1-15 | September 25 |

| September 16-30 | October 10 |

| October 1-15 | October 25 |

| October 16-31 | November 10 |

| November 1-15 | November 25 |

| November 16-30 | December 10 |

| December 1-15 | December 25 |

| December 16-31 | January 10 |

MONTHLY - ANNUAL WITHHOLDING $1,200.01 to $8,000.00:

| REPORTING PERIOD | DUE DATE |

|---|---|

| January | February 15 |

| February | March 15 |

| March | April 15 |

| April | May 15 |

| May | June 15 |

| June | July 15 |

| July | August 15 |

| August | September 15 |

| September | October 15 |

| October | November 15 |

| November | December 15 |

| December | January 15 |

QUARTERLY - ANNUAL WITHHOLDING $200.01 to $1,200.00:

| REPORTING PERIOD | DUE DATE |

|---|---|

| January, February, March | April 25 |

| April, May, September | July 25 |

| July, August, September | October 25 |

| October, November, December | January 25 |

ANNUALLY - ANNUAL WITHHOLDING $.00 to $200.00:

| REPORTING PERIOD | DUE DATE |

|---|---|

| January - December | January 25 |

COMPLETING A KW-5 DEPOSIT REPORT

You must file a KW-5 Withholding Tax Deposit Report for EACH reporting period even when no Kansas tax was withheld. Even annual filers must file a KW-5 for the tax year - a KW-3 annual return does NOT take the place of an annual KW-5 Deposit Report.

Kansas withholding tax reports must be filed and payment of tax made electronically. Although there are several methods available to file and pay electronically, the following example illustrates how to use our simple and FREE online application, available through the Kansas Customer Service Center (KCSC) on our website (ksrevenue.org).

For more information about filing and paying your Kansas business taxes, see File, Pay and Make Updates, herein.

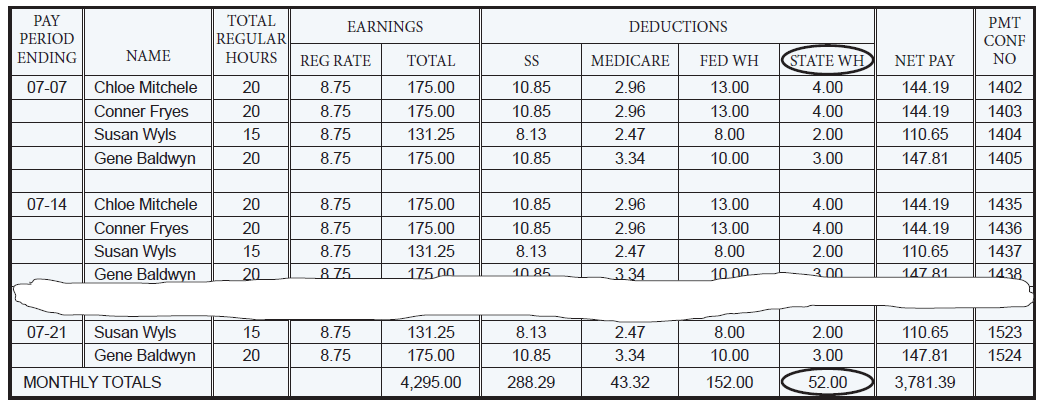

EXAMPLE: David , president of ABC Lumber Company, pays his employees on a weekly basis.His filing frequency for Kansas withholding tax is monthly and he uses a spreadsheet to maintain his payroll records — a portion of which is shown here. Using his spreadsheet he follows the five steps shown here to report and pay Kansas withholding tax for his July, 2021 tax period.

STEP 1: Go to ksrevenue.org to begin the sign-in process for the KDOR Customer Service Center (KCSC). If you are a first time user click Register and complete the registration page. If already registered, click Login and enter your e-mail address and password to sign-in. If using “ACH Credit” method of payment, follow instructions in step 2; otherwise go to Step 3.

STEP 2: On the Home menu, click EF-101 Electronic Funds Transfer Authorization Form below the blue menu bar on the left. Complete all required fields and click Submit. Verify the information for accuracy and click Continue. You will be presented links to the appropriate addenda format and filing frequency schedule.

STEP 3: Select Accounts on the yellow menu bar at the top of the page, then click Add an Existing or Register a New account to this login. Enter your “tax account identification number” and “access code” and click Continue, then Save. NOTE: Once you have added your account, it will be retained in the system for future filing periods.

STEP 4: Select Manage Account, scroll to the menu list at the bottom of the page, and click Payment with KW-5 Coupon. Review the information and:

- click the Period and Year (in this example “July” and “2021”) from the dropdown menu for your reporting period;

- from the dropdown menu Withholding Payment & Return, click the Payment Type;

- in dollars and cents, enter the “total dollar amount of Kansas withholding tax due” ($52.00 for this example) and, if applicable, enter any “penalty” and “interest” amounts;

- enter your Settlement Date;

- complete the Payment Funding Source section and click Continue.

STEP 5: Verify the information you entered and click Submit Payment. A Payment Detail page that provides your confirmation number displays to print and keep with your business tax records. It is also retained in the online Account History page.

CORRECTING A KW-5 DEPOSIT REPORT

The online application within the KDOR Customer Service Center (KCSC) supports the electronic process of making additional payments. However, if you need to file an amended or corrected KW-5 Deposit Report, you must use a paper form.The following instructions explain how to accurately correct a previously-filed KW-5 deposit report.

UNDERPAYMENTS

If you have paid less than the actual taxes withheld in a period, you will need to file an additional KW-5 for that period. To file your additional KW-5, log into the KCSC and access your Withholding tax account. Select the option Payment with KW-5 coupon to process another return and payment for the amount of tax that was underpaid for that tax period.

An additional KW-5 deposit filed after the original due date is subject to a penalty (and interest when applicable) on the additional amount of tax. For more information about late charges, see page 13.

OVERPAYMENTS

Credit to next period(s). If you paid more than the actual taxes withheld in a period, the credit may be applied to the tax due for subsequent withholding period(s) within the same calendar year. To use a credit from a prior deposit period in the same calendar year, complete line 2 of a paper KW-5 form.

Amended KW-5s. When an overpayment cannot be recaptured or used in subsequent periods within the same calendar year, the overpayment will generally be reflected on your KW-3 (Annual Withholding Tax Return) and resolved the following calendar year — see Credit Memo that follows. However, for situations where a refund of the overpayment is requested during that calendar year, you will need to file an amended KW-5 for each affected period. Using a paper KW-5, complete all the information on the form and place an “X” in the “Amended Return” box. Enter the correct amount of tax for each reporting period on line 1 of the amended KW-5. You should include a letter explaining the error that caused the overpayment.

CREDIT MEMO

When any overpayment during a calendar year cannot be recaptured during that same calendar year, or when an audit of the KW-3 (Annual Withholding Tax Return) and W-2 and/or W-2c forms results in an overpayment, the Department of Revenue will issue a Credit Memo. A Credit Memo is a letter that explains the source of the credit, the amount of the credit and instructions for its use.

Report the credit memo amount on your next KW-5 filing. If the credit is greater than the tax being reported, report the remainder on the following tax period. If you have questions, contact our tax assistance center.

IMPORTANT: A copy of the credit memo letter must accompany each KW-5 Deposit Report that is using the credit. A credit from a prior year cannot be deducted on line 2 of a KW-5 Deposit Report without a credit memo.

ANNUAL RETURNS AND FORMS

As an employer/payer, you have additional forms to complete after the close of the calendar year for your employees, payees, state and federal government.

COMPLETING AN ANNUAL KW-3 WITHHOLDING TAX RETURN

Form KW-3 is your annual Kansas withholding tax return for the calendar year and serves two important purposes. First, it summarizes your withholding deposits for the calendar year, allowing us to match your deposit record with ours. Second, it is the transmittal document for sending the “State” copy of the Wage and Tax Statement (Form W-2) and any 1099 forms that have Kansas withholding to the Department of Revenue.

The annual return, W-2s and 1099s are due by January 31 of the following year. Form KW-3 must be filed electronically (see File, Pay and Make Updates herein).

PARTIAL-YEAR REPORTING

If you begin business or begin withholding during a calendar year, file the KW-3 and W-2s for that portion of the year Kansas income tax was withheld. See the example that follows.

IMPORTANT: If you close or sell the business or discontinue withholding, your final reports are due within thirty (30) days after the end of the month in which the business closed or the last date wages were paid. File the KW-3, W-2s, and 1099s/W-2Gs with the Department of Revenue, along with notification of business closure or change of ownership. See Closing Your Withholding Account herein.

EXAMPLE: John, a monthly filer, began a curbside pick-up restaurant business in Kansas in March, 2020. He filed his monthly KW-5 deposit reports using the Kansas online application. His annual return (KW-3) is now due and he uses the following steps to complete it electronically.

STEP 1: Go to ksrevenue.org to begin the sign-in process for the KDOR Customer Service Center (KCSC). If you are a first time user click Register and complete the registration page. If already registered, click Login and enter your email address and password to sign-in.

STEP 2: Select Accounts on the yellow menu bar at the top of the page, then click Add an Existing or Register a New account to this login. Enter your “tax account identification number” and “access code” and click Continue, then Save. NOTE: Once you have added your account, it will be retained in the system for future filing periods.

STEP 3: Select Manage Account, scroll to the list at the bottom of the page and click File your KW-3 Tax Information to KDOR. An informational page appears with updates and/ or tips for using the system. Please take the time to read the information before clicking Continue.

STEP 4: Complete the “Name and Address” section and:

- from the dropdown menu, enter the “Tax Year” for which you are filing (2020 and Original for this example);

- enter “Return Type” (for this example, KW-3) and click Continue;

- enter payments made by “Period End Date” (for this example you begin with March) and “Payment Amount” and click Calculate Totals and then click Continue;

- enter “Total number of Kansas W-2s and/or federal 1099 forms” and click Calculate Totals, then click Continue.

STEP 5: Verify the information as entered. Read the “Return Verification and Agreement”, select “I Agree”, enter the “Filer’s Name and Filer’s Title” and then click Submit.

STEP 6: A confirmation page displays to print and keep with your records. Proceed with filing W-2s by clicking on file your W-2s by clicking here. (The following section explains the W-2 process in detail.)

WAGE AND TAX STATEMENT (W-2)

Furnishing W-2s to Employees.

Employers must give each employee three copies of the Wage and Tax Statement, Form W-2, by January 31 of the following year, even if no Kansas tax was withheld. Payers must also provide each recipient for whom Kansas tax was withheld with three copies of the appropriate Wage and Tax Statement (W-2, W-2G, W-2P, etc.) by January 31 of the following year.

If an employee/payee leaves during the year, you may either furnish the appropriate W-2 with the last payment, or wait until the end of the year. Keep any W-2 forms returned by the postal service with your other payroll records as proof of attempted delivery.

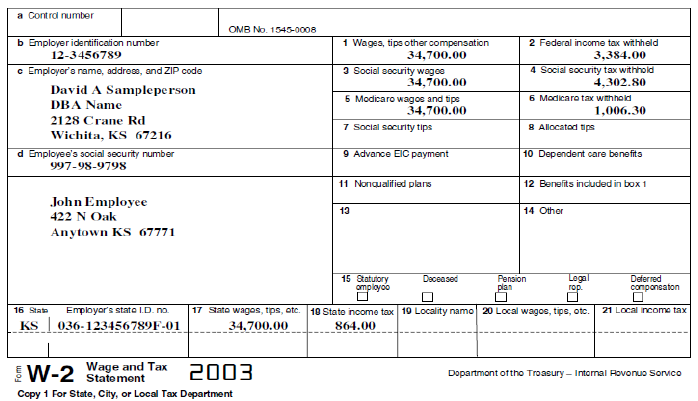

You may obtain paper W-2 forms (copies for federal, state and employer/payer) from the IRS – an order blank is in federal Pub. 15 (Circular E). W-2s are also available from office supply retailers or may be printed using payroll software. A sample completed W-2 follows.

COMPLETING A W-2

You will report Kansas wages and withholding in the State information boxes of the W-2 form. You must enter the complete Kansas Withholding Tax Account Number (i.e., 036-XXXXXXXXXF-01) in the box labeled Employer’s state I.D. number on the W-2.

If you are completing a W-2 for an employee for whom you have withheld taxes for more than one state, enter in the Kansas boxes only the wages and withholding applicable to Kansas.

Be sure that the figures and information are legible on all copies. If they are not, you may need to reissue the W-2.

REISSUING A W-2

If an individual’s W-2 form has been lost, destroyed, or is illegible, you may reissue the W-2. Complete another W-2 for that tax year and mark it “Reissued by Employer.” Do not send copies of reissued W-2 forms to the Department of Revenue.

CORRECTING A W-2 (USING FORM W-2C)

To correct the information on a W-2, use federal Form W-2c, Statement of Corrected Income and Tax Amounts. Furnish three copies to the employee and submit a copy to the Department of Revenue only when the correction affects the Kansas information. If the error is found before filing the KW-3 and W-2s with the department (due January 31), include only the W-2c for that employee with the other W-2s and your KW-3. If the error is found after the KW-3 and W-2s have been filed, send the state copy of the W-2c to the Department of Revenue with an amended KW-3 (when applicable) and a short letter of explanation.

FILING THE STATE COPY OF THE W-2 WITH KANSAS

Once completed, a copy of the W-2 form must be submitted to the Department of Revenue. Employers submitting more than 50 W-2 records must file electronically (see Electronic File and Pay Options herein). Employers reporting less than 51 records can file on paper but are encouraged to use our online application to submit their W-2s. Submitting W-2 forms electronically gives you the option of inputting the W-2 information individually or uploading pre-formatted files as specified in the Record Format and Layout Specifications section that follows.

NOTE: Your Kansas KW-3 Annual Withholding Tax Return must be filed electronically along with the W-2s and 1099s.

If you have less than 51 forms you may submit the paper W-2 copies marked “For State, City or Local Tax Department” (Copy 1) to the Department of Revenue in either Social Security Number or alphabetical order. Also include a copy of the electronically filed KW-3 submission done online.

RECORD FORMAT AND LAYOUT SPECIFICATIONS

Electronic W-2 filers have the option of uploading fixed- length or comma separated value (CSV) files.

For fixed-length format, filers are required to follow the filing specifications listed in the Social Security Administration booklet (EFW2/EFW2C, Specifications for Filing Forms W-2 and W-2c Electronically) for all records except the Code RS (state) record. These specifications are available at: ssa.gov/employer/pub.htm

For details regarding the Kansas Code RS record, refer to the K-2MT, Kansas W-2 Specifications for Electronic Filing (EFW2 format) document available on our website: ksrevenue.gov/forms-btwh.html

Most popular spreadsheet programs can create CSV files suitable for upload. It may also be possible to export withholding information out of your accounting software into CSV format. In both cases, it is necessary that CSV files be formatted as outlined in the KW-2CSV, W-2 Specifications for Electronic Filing.

CAUTION: Electronic W-2 files that do not conform to either the EFW2 or CSV specifications will not be accepted.

ANNUAL INFORMATION RETURNS (1099 and 1096)

In addition to W-2 forms, you may be required to file information returns for the taxable non-wage payments you made during the tax year. Information returns include federal forms 1098, the 1099 series, 5498 and W-2G. If you are required to file an information return with the Internal Revenue Service (IRS), a copy must also be filed with the Department of Revenue by January 31 following the end of the calendar year. As with W-2s, Kansas requires that employers/payors with more than 50 records, per type of information return, file electronically. Filers can upload files that are in a fixed-length format consistent with the layout specified in the IRS Pub. 1220 available on the IRS website. Filers may also upload a properly-formatted CSV file. These files must be formatted as outlined in the K-99CSV Information Returns Specifications for Electronic Filing, available on our website.

COMBINED FEDERAL/STATE FILING PROGRAM (CF/SF)

A separate filing of information returns to Kansas may not be necessary if you participate in the IRS CF/SF Program. Established to simplify filing, participants in this program send the 1099s and 1096 to the IRS only. The IRS then forwards the information to the Department of Revenue. Obtain IRS Pub. 1220 for details about the combined filing program.

CAUTION: Information returns that have Kansas withholding may NOT be filed under the CF/SF program. You must use the electronic application to submit 1099s with Kansas withholding, along with the KW-3. As with electronically filed W-2s, KW-3, information is entered during the 1099 upload process.

ADDITIONAL INFORMATION

WHEN RETURNS ARE LATE

There are penalties for late filing or late payment of Kansas withholding deposit reports and returns. All late charges are computed as a percentage of the tax due, and are automatically billed by the Department of Revenue when you do not calculate and pay them with a late deposit or return.IMPORTANT: You may be subject to non-filer penalties when KW-5 deposits, KW-3 returns, or W-2 forms are not filed. If you have a Kansas withholding tax registration, you must file these returns and documents even when no Kansas tax was withheld.

PENALTY

Penalty rates increase over time. Reports filed on time without payment of tax due have the same penalties as those that are filed late.

A penalty of 15% is charged on any tax that is reported or paid after the due date and prior to February 1 of the following year. An additional penalty of 1% per month (up to a maximum of 24%) is assessed on tax filed or paid after January 31 of the following year (due date of the KW-3 return).

A 50% penalty may be assessed when an employer fails to submit a delinquent return within 20 days following written notice from the Director of Taxation. This penalty is in addition to the total KW-5 and KW-3 underpayment penalties.

INTEREST

Interest is not charged if the tax due on a KW-5 report or KW-3 return is filed and paid prior to the due date of the annual return (February 1 of the following year). Tax paid on or after February 1 of the following year is charged interest from that February 1 to the date the return is filed and/or the tax paid.

Since the Kansas interest rate is based on the federal underpayment rate in effect on July 1 of the prior year, it is subject to change each year [K.S.A. 79-2968]. See our website at ksrevenue.org for a chart of Kansas interest rates.

WAIVER OF PENALTY

If your deposit is late due to an event beyond your control, you may request a waiver of the penalty. Simply write a letter with the specific circumstance(s) that caused the delinquency and request that the penalty be eliminated. Be sure to include your EIN, filing period and a daytime phone number. Send your request with the billing that you received for the late charges.

IMPORTANT: If there is interest due it must be paid before a request for waiver of penalty will be considered or approved. While interest may not be waived, the rate of interest may be reduced.

OTHER PENALTIES

Returned check fee. A fee of $30 (plus the cost for a registered letter) is charged on returned checks. This fee is in addition to any other penalty or interest.

Form W-2. An employer/payer who willfully fails to furnish an employee/payee with a W-2 by January 31 of the following year may be subject to a fine up to $100 for each occurrence. An employer/payer who fails to file the “State” copy of the W-2 with the Department of Revenue by January 31 may be subject to a penalty of $50 for each W-2 not submitted.

Bond. Any employer/payer who fails to pay withholding tax for more than one period may be required to post a sum of money as a bond to secure against non-payment of the tax. The bond amount is determined by the Department of Revenue, and may be up to a maximum of the tax estimated to be due and payable for two quarterly payment periods. [K.S.A. 79-3294b]

Fraud. The law imposes fines up to $1,000, imprisonment and penalties on any employer/payer who with fraudulent intent fails to file or pay withholding tax, or who signs a fraudulent return.

EMPLOYER/PAYER AND OFFICER LIABILITY

Every employer/payer is liable to the state for payment of the income tax deducted and withheld from wages and other payments subject to Kansas income tax withholding. Officers and directors of a corporation, like sole proprietors and partners, are personally liable for the Kansas withholding tax, penalty and interest due during the period they hold office. [K.S.A. 79-32,100c]

EXAMPLE: A corporation fails to remit its withholding tax. The corporation and each officer, director, or other responsible party bill having control, receipt, custody or disposal of, or paying the wages of employees, will be personally liable for this corporate debt.

ABOUT OUR BILLING PROCESS

Most functions of the Department of Revenue’s billing process are computerized. A tax bill is automatically generated when our system detects a deficiency on your account. A deficiency may be either a balance due or a missing return. It is important that you immediately respond to a tax bill from the Department of Revenue and, when making payment, follow the instructions on the bill.

If the only problem on an account is a missing return, the bill will show a zero balance due. However, the missing periods are listed on page 2 of the bill with a “Y” for “Yes” in the column entitled “Non-Filed Returns.” To avoid assessments for these missing periods, file the missing reports or contact us with the filing information.

If you have questions about a tax bill, have already paid the balance or filed the missing periods, call us at the number on the billing. Our customer representatives can help you understand and respond to a tax bill.

REPORTING BUSINESS CHANGES

When changes occur in your business, promptly notify the Department of Revenue (see Taxpayer Assistance at the bottom of this page). Please have your tax account number available when calling our office.

BUSINESS NAME AND/OR ADDRESS CHANGE

You may report business name or address changes to us by mail or fax, using company letterhead or by completing our form DO-5 Name or Address Change. This form is available on our website.

CHANGE OF CORPORATE OFFICERS OR DIRECTORS

When there is a change in your corporate officers or directors, complete and return form CR-18 Ownership Change, and provide the name(s) and title(s) of the resigning officer(s) or director(s). If you prefer, mail or fax us a letter with the name, title, home address, and Social Security number of each new corporate officer or director, the name and title of each officer or director resigning, and the effective date of the change.

Change of partners. If your business is a partnership, and less than 50% of the partnership is changed, follow the Change of Corporate Officers or Directors instructions to report the new information on each partner. However, if 50% or more of the partners in a partnership change, a new Kansas Tax Account Number is required. Follow the Change of Business Ownership instructions below to cancel your existing number and apply for a new number.

Change of business ownership. When the ownership changes, a new registration is required. Examples of ownership changes are: 1) sole proprietorship to a partnership, 2) 50% or more of the partners in a partnership change 3) partnership to a corporation, 4) one corporation to another corporation, or, 5) any change in corporate structure that requires a new charter, certificate of authority or new federal EIN.

To apply for a new Kansas Tax Account Number, see How and When to Register herein.

IMPORTANT: Before a new registration can be issued, the existing registration must be canceled as of the effective date of the ownership change. See Closing Your Withholding Account that follows.

CHANGING YOUR FILING FREQUENCY

Once a filing frequency is established for a calendar year, do not increase or decrease the frequency of filing your KW-5 reports. Filing less frequently will cause you to receive non-filer tax bills for missing periods.

The Department of Revenue periodically reviews the deposit history of each Kansas withholding account to ensure the filing frequency is in accordance with the guidelines mandated by law. This is usually done late in a calendar year, so that any change necessary will take effect January 1 of the upcoming year. A notice of change is usually mailed to the affected accounts in November.

We realize errors can occur when a filing frequency is assigned to a new business. In addition, a business can change extensively over a calendar year, causing the withholding filing frequency to be too often or not often enough. If you believe your filing frequency is out of line with the chart on page 10, contact the Department of Revenue.

CLOSING YOUR WITHHOLDING ACCOUNT

When you sell or change the ownership of the business, close your business, or are no longer making payments subject to Kansas withholding, you must cancel your Kansas Tax Account Number. Use one of the following forms to notify the Department of Revenue:

- CR-108 Notice of Discontinuation of Business.

- The Discontinuation of Business portion of your Withholding Tax Registration Certificate.

- CR-18 Ownership Change Form – available on our website.

When you close your withholding account, all of the required forms (KW-5s, KW-3, W-2s, etc.) must be filed within 30 days after the end of the month in which the business closed or payment of wages ceased, regardless of the usual reporting period due date.

WHEN IN DOUBT...

Kansas withholding tax law generally conforms with the federal law. Therefore, if you have questions about whether a payment is subject to withholding, or whether a worker is your employee or is an independent contractor, contact the IRS or the Kansas Department of Labor.

When you have a Kansas tax question or situation that is not addressed in this publication, contact the Department of Revenue for assistance. Although our customer service personnel are able to answer most questions, there are situations that may require an interpretation or clarification based upon the law, regulations and specific facts. When this happens, document the situation in writing and request a written opinion from the Kansas Department of Revenue. Email your letter to:

KDOR_tac@ks.gov (KDOR_tac@ks.gov)

In the Subject Line RE: Request for Opinion Letter

Attn: Policy and Research

KANSAS DEPARTMENT OF REVENUE WEBSITE (KSREVENUE.ORG)

Perhaps the most useful resource available to taxpayers is our website. Items there include tax forms and instructions, informational publications, electronic filing information, economic development incentives, links to the IRS and other business sites, and our Policy Information Library.

POLICY INFORMATION LIBRARY (https://www.ksrevenue.gov/prpil.html)

A library of policy information for all taxes administered by the Department of Revenue is a part of our web site. This policy library contains the Kansas Statutes and Regulations, Revenue Notices, Revenue Rulings and other written advice issued by the Department of Revenue. Opinion Letters and Private Letter Rulings are also included, however, these letters have been “scrubbed” to protect the privacy of the taxpayer — any information that would identify the taxpayer, such as name, address, product, etc., is blanked out. For ease in locating information, you may search the library by tax type and topic.

KEY STATUTES

Kansas Statutes Annotated (K.S.A.) that were used as the basis for this guide include K.S.A. 79-3228, K.S.A. 79-3294 et seq., and K.S.A. 79-32,107.

OTHER REQUIREMENTS AND RESOURCES

Income tax withholding is just one responsibility of an employer. This section summarizes and provides resource information on some of the other federal and state obligations you have as an employer.

FEDERAL REQUIREMENTS

EMPLOYER IDENTIFICATION NUMBER (EIN)

If you pay wages to one or more employees, or if your business structure is a partnership, corporation, trust, estate, or nonprofit organization, you must have a federal EIN. This is a nine-digit number (00-0000000) issued by the IRS. It is used to identify the tax accounts of businesses for federal tax purposes. To apply for a number, complete federal Form SS-4, Application for Employer Identification Number.

To obtain an EIN or for information about federal income tax withholding, Social Security, Medicare or federal unemployment tax, visit their website (www.irs.gov).

U.S. CITIZENSHIP AND IMMIGRATION SERVICES (USCIS)

The Federal Immigration Reform and Control Act of 1986 requires all employers to verify the employment eligibility of new employees. For assistance with this process or to obtain forms, visit the INS website (uscis.gov).

U. S. DEPARTMENT OF LABOR

The Fair Labor Standards Act (FLSA) is the federal law that sets minimum wage, overtime, record keeping and child labor standards. More information is available by visiting the website for the Wage and Hour Divisions (dol.gov/whd/contact_us.htm).

KANSAS REQUIREMENTS

KANSAS UNEMPLOYMENT TAX AND WORKERSCOMPENSATION

The Kansas Employment Security Law was enacted to providesome income during limited unemployment for those who are outof work due to conditions in the economy and through no fault of their own. All Kansas employers are required to file a report with the Kansas Department of Labor (KDOL), to determine their unemployment tax status.

Kansas workers compensation is a private insurance planwhere the benefits are not paid by the State of Kansas but rather by the employer, generally through an insurance carrier. For more information on Kansas unemployment tax or Kansas workers compensation visit KDOL website (www.dol.ks.gov).

BUSINESS RESOURCE DIRECTORY

SAFETY AND HEALTH

The Occupational Safety and Health Administration (OSHA) outlines specific healthandsafety standards adoptedby the U.S.Department of Labor. For more information, visit their website (www.osha.gov).

The Industrial Safety and Health Section of the Kansas Department of Labor (KDOL) offers free safety and health consultations. For additional information, visit KDOL’s website (www.dol.ks.gov).

SMALL BUSINESS ADMINISTRATION (SBA)

The SBA is the only federal agency solely dedicated to serving the needs of America’s small businesses. For more information visit their website (sba.gov).

KANSAS DEPARTMENT OF HEALTH AND ENVIRONMENT

The Kansas Department of Health and Environment provides resource information for questions or issues of an environmental nature (kdheks.gov).

AMERICANS WITH DISABILITIES ACT (ADA)

The ADA prohibits discrimination on the basis of disability, providing coverage for employment, public services, government, transportation and telecommunications. For more information regarding your responsibilities under this act, contact the Kansas Commission on Disability Concerns at 1-800-295-5232.

KANSAS DEPARTMENT OF COMMERCE

The Kansas Department of Commerce provides resource and referral information for Kansas businesses (kansascommerce.gov).

KANSAS SECRETARY OF STATE

To register a corporation in Kansas, or to obtain corporate annual reports, visit the Kansas Secretary of State website (kssos.org).

KANSAS SMALL BUSINESS DEVELOPMENT CENTER(KSBDC)

There are a number of campus-based centers throughout Kansas that specialize in providing direct one-on-onecounseling on small business issues. Contact their website for more information (kansassbdc.net).

TABLES FOR PERCENTAGE METHOD OF KANSAS WITHHOLDING

(For wages paid on and after January 1, 2021)

NOTE: The wage amounts are after withholding allowances have been subtracted.

TABLE 1 — WEEKLY PAYROLL PERIOD

(a) SINGLE person (including Head of Household)

If the amount of wages (after withholding allowance is over $0 but not over $67 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $67 but not over $356 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $67.

If the amount of wages (after withholding allowance is over $356 but not over $644 then the amount of KANSAS income tax to be withheld is $8.94 + 5.25% of excess over $356.

If the amount of wages (after withholding allowance is over $644 then the amount of KANSAS income tax to be withheld is $24.09 + 5.7% of excess over $644.

(b) MARRIED person

If the amount of wages (after withholding allowance is over $0 but not over $154 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $154 but not over $731 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $154.

If the amount of wages (after withholding allowance is over $731 but not over $1,308 then the amount of KANSAS income tax to be withheld is $17.88 + 5.25% of excess over $731.

If the amount of wages (after withholding allowance is over $1,308 then the amount of KANSAS income tax to be withheld is $48.17 + 5.7% of excess over $1,308.

TABLE 2 — BI-WEEKLY PAYROLL PERIOD

(a) SINGLE person (including Head of Household)

If the amount of wages (after withholding allowance is over $0 but not over $135 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $135 but not over $712 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $135.

If the amount of wages (after withholding allowance is over $712 but not over $1,288 then the amount of KANSAS income tax to be withheld is $17.88 + 5.25% of excess over $712.

If the amount of wages (after withholding allowance is over $1,288 then the amount of KANSAS income tax to be withheld is $48.17 + 5.7% of excess over $1,288.

(b) MARRIED person

If the amount of wages (after withholding allowance is over $0 but not over $308 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $308 but not over $1,462 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $308.

If the amount of wages (after withholding allowance is over $1,462 but not over $2,615 then the amount of KANSAS income tax to be withheld is $35.77 + 5.25% of excess over $1,462.

If the amount of wages (after withholding allowance is over $2,615 then the amount of KANSAS income tax to be withheld is $96.35 + 5.7% of excess over $2,615.

TABLE 3 — SEMI-MONTHLY PAYROLL PERIOD

(a) SINGLE person (including Head of Household)

If the amount of wages (after withholding allowance is over $0 but not over $146 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $146 but not over $771 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $146.

If the amount of wages (after withholding allowance is over $771 but not over $1,396 then the amount of KANSAS income tax to be withheld is $19.38 + 5.25% of excess over $771.

If the amount of wages (after withholding allowance is over $1,396 then the amount of KANSAS income tax to be withheld is $52.19 + 5.7% of excess over $1,396.

(b) MARRIED person

If the amount of wages (after withholding allowance is over $0 but not over $333 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $333 but not over $1,583 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $333.

If the amount of wages (after withholding allowance is over $1,583 but not over $2,833 then the amount of KANSAS income tax to be withheld is $38.75 + 5.25% of excess over $1,583.

If the amount of wages (after withholding allowance is over $2,833 then the amount of KANSAS income tax to be withheld is $104.38 + 5.7% of excess over $2,833.

TABLE 4 — MONTHLY PAYROLL PERIOD

(a) SINGLE person (including Head of Household)

If the amount of wages (after withholding allowance is over $0 but not over $292 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $292 but not over $1,542 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $292.

If the amount of wages (after withholding allowance is over $1,542 but not over $2,792 then the amount of KANSAS income tax to be withheld is $38.75 + 5.25% of excess over $1,542.

If the amount of wages (after withholding allowance is over $2,792 then the amount of KANSAS income tax to be withheld is $104.38 + 5.7% of excess over $2,792.

(b) MARRIED person

If the amount of wages (after withholding allowance is over $0 but not over $667 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $667 but not over $3,167 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $667.

If the amount of wages (after withholding allowance is over $3,167 but not over $5,667 then the amount of KANSAS income tax to be withheld is $77.50 + 5.25% of excess over $3,167.

If the amount of wages (after withholding allowance is over $5,667 then the amount of KANSAS income tax to be withheld is $208.75 + 5.7% of excess over $5,667.

TABLE 5 — QUARTERLY PAYROLL PERIOD

(a) SINGLE person (including Head of Household)

If the amount of wages (after withholding allowance is over $0 but not over $875 then the amount of KANSAS income tax to be withheld is $0.

If the amount of wages (after withholding allowance is over $875 but not over $4,625 then the amount of KANSAS income tax to be withheld is 3.1% of excess over $875.

If the amount of wages (after withholding allowance is over $4,625 but not over $8,375 then the amount of KANSAS income tax to be withheld is $116.25 + 5.25% of excess over $4,625.

If the amount of wages (after withholding allowance is over $8,375 then the amount of KANSAS income tax to be withheld is $313.13 + 5.7% of excess over $8,375.

(b) MARRIED person

If the amount of wages (after withholding allowance is over $0 but not over $2,000 then the amount of KANSAS income tax to be withheld is $0.